Rising Interest Rates–and why you don’t need to worry?

I keep hearing it over and over, “rates are going up, I think I’ve missed my chance to buy or invest!” Well, I’m here to tell you that it’s not too late–and it won’t be too late for the foreseeable future. In fact, buying and investing long term will only be getting better – even with rising rates!

It is an unprecedented time in U.S. history when buyers and investors– particularly first-time buyers and newer investors– are on high alert. The media is touting home sales at all-time highs, and many with multiple (if not dozens) offers within the first 24 hours. This hysteria bubble-hype also seems to be creating an increasing number of incredulous buyers and investors, now thinking it’s not possible or worthwhile to invest. This idea is not accurate!

If you fall into this category, this short article will provide some hope.

Top Three Reasons Why I Know It Is Still An Excellent Time to Buy:

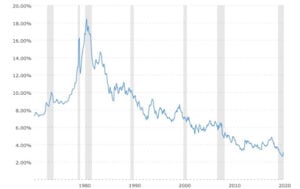

First, interest rates are still historically low. Current rates are near 3% now and likely rising over the next 2-5 years. Perspective matters–and so does education (but we will get to that in a minute). When I recently asked my mother and father how much they spent on their first property,

they said they paid around 10.5% interest! I can’t imagine how difficult that was at the time.

For a visual perspective–here is a chart from macrotrends.net that shows 30 year fixed mortgage rates from 1970-2020. As you can see, interest rates are still what I would consider low.

Next, our community and platform, Active Duty Passive Income, teaches the foundation on how to buy right and become a military real estate buyer or investor!

If you are active military and still PCS’ing around the country–before you buy, you must consider (and evaluate) your next home purchase as a potential future investment property. Frequently, we use the fantastic benefits of the VA loan to buy– which can leave us in a highly-leveraged position on the loan in a couple of years. If you aren’t buying with intention, you could end up with a great home, but one does not make a great rental after your next PCS.

You can learn more about some unique approaches– including how to buy a residential multifamily property with the VA loan– in our free bestselling book, “Military House Hacking.”

If you are a separated or retired Veteran, you can follow these same steps.

Investing Education is Key

Additionally, our 85+ lesson Military Real Estate Investing Academy will help you learn all you need to know to get your first or next deal/home. ADPI’s nationwide network of educated Realtors can help you find it, and our in-house lending team can get you the funding you need.

My point here is that regardless of today’s interest rates– if you educate yourself, prepare, and have the right resources, you can still find great deals and make them cashflow well.

Finally, I understand we are all inherently looking for immediate gratification, quick profits, and strong cash positions. But, let me explain my personal experience on a couple of recent purchases and why the “buy and hold” strategy is essential.

Back in late 2017, early 2018, I purchased two properties from Bridge Turnkey in Kansas City. Turnkey (TK), if you don’t know already, is when a TK company buys a property, renovates it, inspects it, gets a tenant and property manager in place, then sells it to you an investor – all while cash flowing from day one.

These properties – my first actual investment deals – were purchased with about a 25% down payment, with interest rates of 4.75% each. At the time, I was pretty happy with these rates– especially given that they were investment properties, which are typically a whole percentage point higher than an owner-occupied loan. But, I also understood that 4.75%

was a bit “high” (again, perspective) and would ultimately eat into some of the cash flow.

These properties produced net cashflow of about $200 and $400/month, respectively.

Buy & Hold Investing

Here’s where it gets good – and why having a “buy and hold mentality” is pertinent.

In January of 2021, I was able to do cash-out refinances on both of these properties, reducing the interest rates from 4.75% to 2.75%. I pulled $47,000 cash out of them (cash into my pocket

to reinvest in more deals!)– and here’s the best part–the payments went DOWN–increasing monthly cashflow.

So, if you can buy a good deal now that cashflows, even as rates rise, DO IT! Just be smart about it.

If you are in the camp of worrying about what social media is saying about rising rates, slim margins, and hard-to-find deals–I hope this article lit a spark in you to start digging in so you can form your own opinion.

You can find deals when you research, have the right resources (many given here) and have the right mentality to take consistent action towards your goals.

Remember the success formula:

- Learn all you can.

- Network your butt off.

- Add value to others.

- Take massive action.

If you do these four things consistently, intending to be only 1% better daily, success will hunt YOU down!

Whatever it is you want, go and get it. You deserve it!

Post by Eric Upchurch

About the author: As part of the Active Duty Passive Income team, Eric has a passion for educating the military community on how to create long term wealth through real estate investing, while personally investing across the country for the last fourteen years.

Eric has been involved in Self-Directed IRA investing, private lending, first trust deeds, tax liens, mobile home parks, multifamily-syndication

s, live-in flips, single family flips, storage units, turnkey buy-and-hold properties and is now invested in over 1100 apartment units as both a General and Limited Partner.