Economic Growth of the Savannah Real Estate Market

The perpetual bears among us have been forecasting an imminent recession and corresponding crash in the housing market since about 2015. Those bears have missed out on considerable asset appreciation since then, but eventually, the bears have got to be right — right?

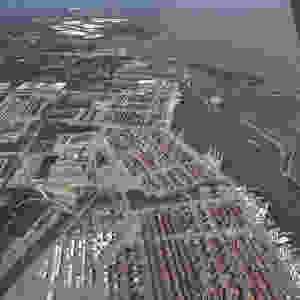

No, at least not in Savannah, and not for quite a while — and the biggest reason why Savannah’s real estate market is still in the third inning is those big, beautiful cranes that we see just upriver of the bridge.

What’s in a Port?

A port is more than just the terminals where ships take on and offload cargo. There are warehouses and yards to temporarily store goods, and planes, trains, and automobiles (and other boats) to move goods closer to the end-user. All this infrastructure and equipment must also be built, maintained, and fueled constantly. Most of this work is done by human beings, who must also be fed, housed, clothed, cared for, and entertained. The dockworkers themselves are just the tip of the spear: truckers, train conductors, boat pilots, tug boat crews, dredgers, engineers, road crews, maintainers, and construction workers also have a part to play, and these people, in turn, support local retail, housing, food, hospitality, entertainment, and healthcare industries.

A port has a large role to play in any community, but exactly how large of a role does the port of Savannah play here?

Savannah’s Port Today

The Port’s Current Impact on Our Community: By The Numbers Port Stats:

Throughput of 4.5 million twenty-foot equivalent units (TEU’s) and 650,000 auto and machinery units in FY 2019.

The port moved 1.5 million TEU’s in FY 2003 and 2.3 million TEU’s in FY 2007, making it the fastest-growing port in the nation.

The port includes:

nine deep-water berths

two class I railroads on-terminal (CSX and Norfolk Southern)

more than 3 million square feet of warehouse space within 30 miles

immediate access to I-16 and I-95

Economic Impact:

In FY 2017, the ports of Savannah and Brunswick were responsible for the employment of 439,220 in Georgia, or 1 of 11 Georgia jobs. This figure was only 275,968 in 2003 — indicating that an increase in TEU’s moved through Georgia ports is directly proportional to job growth.

Chatham County’s share of this employment is 39,025 out of a total population of 290,000.

Personal income derived from port-supported jobs in 2017 was $25B.

In comparison: How does our port stack up?

Savannah is the 23rd busiest port in the nation by tonnage and the 37th largest container port in the world measured by TEU’s.

Fourth busiest container port in the nation with 36 weekly port calls; busiest container port on the east coast.

Savannah’s major limiting factor is it’s relatively shallow draft (42′) and air draft (185′)For comparison, Miami is 50’/unlimited, LA is 52’/unlimited, and NY/NJ is 50’/228′

Savannah’s Port in the Future

The bottom line is this: plans are in motion that will double the yearly volume of TEUs moved through the port over the next ten years. Here’s how:

Dredging is underway which will deepen the harbor to 47′ and allow the larger class of new Panamax ships access to the port. This dredging will be completed in 2020. The Panama canal used to be limited to ships with a 40′ draft. The expansion of the canal allows ships with a 49′ draft passage. The Savannah River will be dredged to 47′ at mean low tide, which will allow this larger class of ship passage.

The port currently has 26 ship-to-shore cranes and there are plans to add 20 more over the next ten years.

Construction of a new mega-rail terminal is underway. This terminal will feature 18 tracks and will allow for 10,000 ft trains to be loaded.

Talks between the GA ports authority and South Carolina’s ports authority are ongoing to open a jointly operated Jasper terminal downriver from Savannah, which will have a draft of 55′ and feature ten births, with an annual capacity of 7 million TEU’s.

Hedge your bets: what if it all goes wrong?

Look, I’m a real estate agent and my job is to sell you on Savannah real estate, but any investor must be mindful of downside risk. What can go wrong here?

- President Trump isn’t exactly a globalist, and globalism is the driving force behind the growth in our port. Trump’s policies have had a direct impact on the growth of the port already — remember those ship-to-shore cranes I mentioned? They come from China, and the President slapped a 30% tariff on those cranes a few months back. From what I read, it seems like Georgia’s senators managed to talk him out of that for the time being, but President Trump’s mercurial decision-making leaves a bit to be desired if you’re an investor who likes predictability.

- The prevalence of rock-bottom interest rates has driven corporate debt through the roof as companies take on debt to buy back shares of stock, among other things. If there were more hours in the day I’d take a look at the balance sheets of companies like CSX, Norfolk Southern, Maersk, IKEA, Hyundai, and others who are heavy hitters at the port — but I still have to make my living showing houses and writing contracts so I’ll leave that research to you if you’re so inclined.

- Climate change is a thing whether you believe in it or not. My take on climate change is this: if it gets bad enough in my lifetime to shut down the port, I’ll have bigger problems to worry about than the value of my real estate assets. Perhaps I should be hedging my bets with canned beans and bullets?

So What?

The port has doubled in size since 2003. The port will double again in the next ten years. Think of how much real estate around here cost in 2003 compared to what it costs now. If you agree with me that a large force behind that appreciation in both asset values and market rent was the port, then call me up and let’s invest in Savannah together.

Pat Wilver got his start in real estate investing in buy-and-hold rentals while still on active duty, and transitioned to working as an investor and agent full time in the Savannah, GA area after separation from active duty. You can reach him at [email protected] with questions or comments about this post.

Works Cited:

- https://www.savannahnow.com/business/20180326/study-one-in-11-georgia-jobs-related-to-savannah-brunswick-ports

- http://www.seda.org/Business-Attraction/Port

- http://www.seda.org/Business-Attraction/Workforce

- https://www.thejasperoceanterminal.com/

- https://www.gpbnews.org/post/why-port-savannah-has-been-smashing-trade-revenue-records

- https://www.gwrr.com/railroads/north_america/savannah_port_terminal_railroad#m_tab-one-panel

- https://www.ajc.com/business/five-things-know-savannah-river-deepening-reaches-midway-point/74QEcjWkPvR1ps8k67xZLM/#

- https://www.marineinsight.com/types-of-ships/the-ultimate-guide-to-ship-sizes/

- https://en.wikipedia.org/wiki/United_States_container_ports

- https://en.wikipedia.org/wiki/List_of_ports_in_the_United_States

- https://en.wikipedia.org/wiki/List_of_busiest_container_ports