Finance Your First Turn-Key Investment

Financing your first turn-key investment can seem like a daunting task. Amongst the array of financial white noise it is difficult to decide how much you need to save for a turn-key investment and how to finance the down payment. This article will answer those questions and lay the financial groundwork for how to financially posture yourself to invest with a turn-key provider.

How much do I need to save for a turn-key investment?

This number is going to depend on the purchase price and the type of financing. For the sake of brevity I will focus on the most common deals that our turn-key providers offer, which are properties with a purchase price between $90,000 and $150,000 with 20% down on a conventional bank loan. For these types of investments, you should target to save between $20k – $30k.

Our providers can also assist you with finding an investment through a self-directed Individual Retirement Account (IRA). This deal will look a little different. Firstly, you need to transfer your IRA to a custodian that will allow you to convert it to a self-directed IRA. Secondly, you need to find and finance a real estate deal. Banks normally will not finance a deal inside your IRA since they cannot access any of your other personal funds in the case of a default, so in most cases you will need to pursue seller financing. With seller financing you will need to save between $35 – $45k. Our providers will walk you through both of these steps. Note that currently you can contribute $5.5k per year to your IRA (limit set by the IRS). If you don’t have enough for an investment now you can either roll over your TSP (upon EAS) or continue to save until you hit the $35k mark.

If $20k seems like a lot to you, do not fret. There are a multitude of options you can pursue to finance your down payment for your first turn-key investment. In this article we will provide 5 ways to finance your down payment.

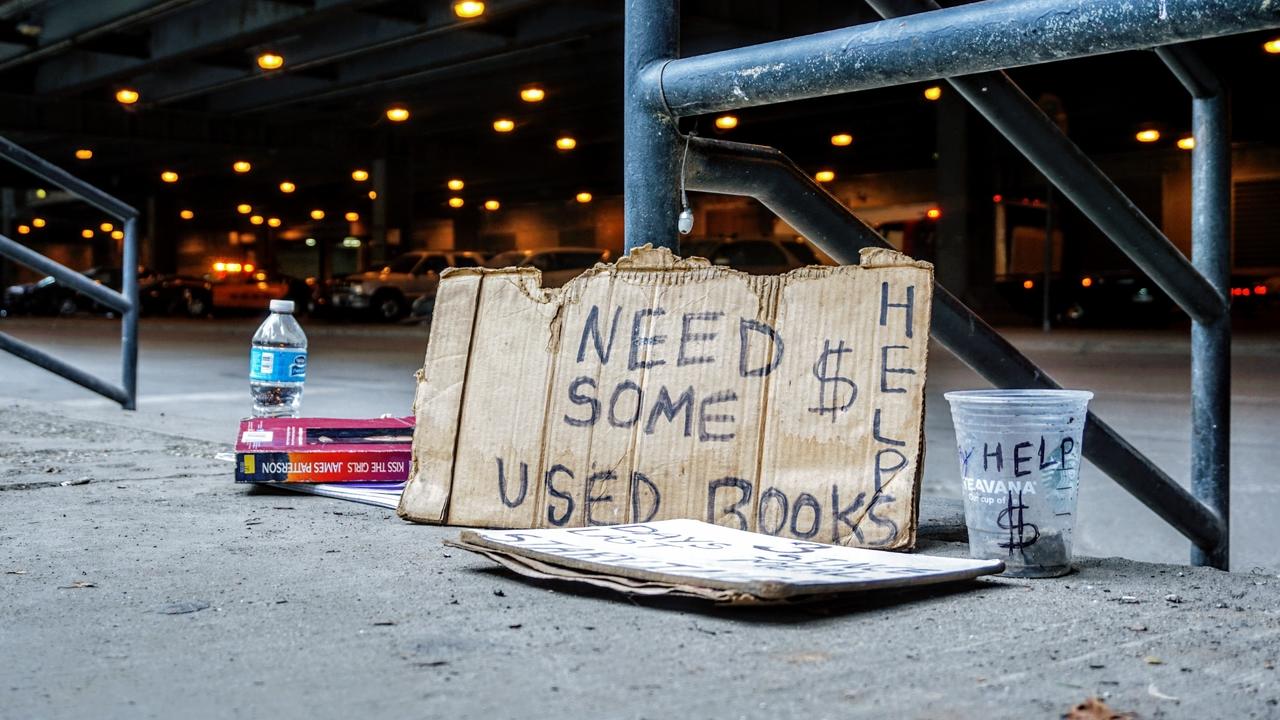

contrary to our blog image, selling used books on the side of the road is not one of them.

- The first and easiest way to finance a down payment is to live frugally and save money in a savings or checking account. A great way to do this is time your investments up with deployments. Contact a turn-key provider around 1 month before you return from deployment so that you can hit the ground running once you get back. Alternatively, you can live frugally in CONUS. A few aggressive, less-common ways to save include: house hacking your primary residence, selling your vehicle and biking / walking to work, and cutting unnecessary expenses. If those options seem a little extreme for you, take the the more common path and consult a financial advisor to establish a budget and savings plan.

- Borrowing from friends and family. We are NOT telling you to beg mom and dad for money, guys. These deals are unbelievable investment opportunities and the more you learn, the more you will want to invest. Simply present information to your friends and family and see if anyone is interested in partnering on a deal. The facts speak for themselves and you may be surprised how many people are interested in real estate investing. Ask your provider or the ADPI team for cash flow statements on past deals so your potential partners can get a feel for what they stand to make on an investment.

- Liquidating brokerage accounts outside of an IRA. This is our opinion. We are saying that investing in turn-key real estate is more lucrative than trying your odds at investing in stocks or mutual funds outside of an IRA. Why? In stocks and mutual funds, you lose on taxes and the competition is out of your league. If you want to learn more, check our blog, check posts in our Facebook group, take our course, or simply google “why investing in stocks is not worth it” or “why you lose on taxes when you invest in a mutual fund.”

- Liquidating a traditional IRA. Contributions to a traditional IRA are from pre-tax income. What this looks like in most cases… You make an income, your employer withholds a certain amount of that income based on your W4, you elect to contribute to a traditional IRA, when tax season rolls around you exempt that contribution on your tax return, you get some money back based on your tax bracket. For example, if you contribute $5,000 to a traditional IRA and you’re in the 25% tax bracket, you will get $1,250 back. THIS IS NOT A LOT. More so, any gains you make will be TAXED when you cash out on your IRA. Alternatively, well structured real estate investments can be TAX FREE, guys. We have run the numbers and have had CPA’s run the numbers for us over and over and REAL ESTATE WINS OVER TRADITIONAL IRA INVESTMENTS (at least our turn-key investments do). If you don’t believe us, run the numbers for your self, reach out on our Facebook group, or contact the team for more details.

- Take out a loan from your TSP. Generally, the TSP funds have pretty good rates of return, which is why this is the last option. However, taking a loan out of your TSP is easy and it can be a great way to get you in the real estate game. You can take a loan out up to 50% of the value of your TSP and elect to pay it back over the course of one to five years (with the ability to make additional payments to pay it back sooner than you elected). The payments will come out of your paycheck just like they do with a TSP allocation. You can do this all online through the TSP website. If you need help, reach out to us on the Facebook group and we can walk you through it.

There you go guys, 5 ways to finance your first turn-key investment. Stay in touch and happy investing.

Authored by: Jon Licht

West Coast Chief, Active Duty Passive Income